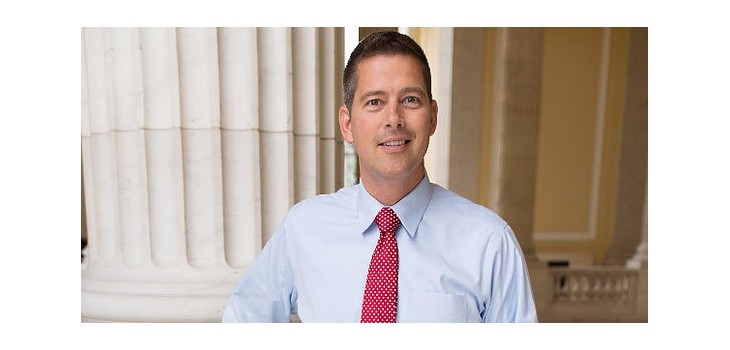

Wisconsin Congressman Sean Duffy sent a letter to the heads of four federal agencies on October 6, 2016, requesting audits of alleged mismanaged federal funds by the LCO Tribe.

Duffy, who is the House Financial Services Oversight & Investigations Subcommittee Chairman, requested that the Departments of the Interior, Housing and Urban Development, Health and Human Services and Bureau of Indian Affairs conduct a forensic audit of all Tribal accounts and programs of the Lac Courte Oreilles (LCO) Band of Lake Superior Chippewa’s.

Duffy made the request on behalf of 113 LCO tribal members after they submitted a petition alleging mismanagement of federal funds by the LCO Tribal Governing Board. The tribal members requested a full forensic audit of all accounts, departments and agencies of or related to tribal activities.

“As constituents of the United States, we request that all audits be conducted in conjunction and with the oversight of all applicable federal agencies,” the petition said.

Duffy said he takes these concerns about mismanagement extremely seriously and he fully supports the petition.

“When over 100 members of LCO request an audit, as a member of Congress, I have a duty to respond to my constituents’ requests, especially when it comes to the oversight of federal tax dollars,” Duffy said.

In his letter to the Secretaries, Duffy said, “The allegedly misappropriated funds should have been used to pay for essential services for the tribal community such as education, healthcare and housing. Instead, health insurance premiums have gone unpaid, schools have fallen into disrepair, and mold contaminations in homes have been left untreated. Members of the Lac Courte Oreilles tribe deserve to know funds provided to their tribe by the U.S. federal government are being spent in an open, accountable and transparent manner. A timely and comprehensive forensic audit of the LCO’s tribal accounts will ensure that all funds are accounted for and being put to the best use possible.”

Duffy requested that the audit be performed and in a timely manner. He also asked that the results be made available to all members of the Lac Courte Oreilles tribe.

Duffy said he’d like to see a thorough accounting of all the federal funds provided to the Lac Courte Oreilles tribe, “in order to allay the concerns of petitioners and ensure the funds are being spent appropriately.”

The LCO Tribe responded on October 12, claiming they are willing to provide any audit information to Congressman Duffy.

“We find it truly unfortunate that Congressman Duffy has not respected our Tribal sovereignty, or the government-to-government relationship, by not directly communicating his concerns to our Tribal leadership,” the LCO Tribal Governing Board said in a media release. “We expected him to know that he can access any annual audits through the Federal Audit Clearing House, where all federal program audits are available.

In response to this statement, Duffy said, “The request for an audit came directly from the tribe’s members. When more than 100 members of the LCO tribe contact their Representative in Congress to request a federal audit regarding federal funds that the tribe receives, I have a duty to assist them.”

Duffy added his office wasn’t aware of any previous federal audits of the Lac Courte Oreilles Tribe.

Communications personnel from the LCO tribal government didn’t respond to questions about if and when any forensic audits have been performed by any outside government agencies. The tribal government conducts its own spot-check independent audits, but not forensic audits, which provide a much more in-depth analysis of financial management and conditions.

“The Tribe fully adheres to all grant requirements, including annual independent audits. As our audits will show, our programs have seen vast improvements over the past several years,” the media release went on to say. “Congressman Duffy has had numerous opportunities for government-to-government relations with the Lac Courte Oreilles Tribe to improve the lives of our Tribal citizens. We stand ready and willing to discuss the needs of our Tribal citizens with Congressman Duffy at any time.”

Duffy said, “We have met on many occasions. I, or a member of my team, has always made every effort to meet with the leadership of Lac Courte Oreilles either in D.C. or Wisconsin.”

The most recent forensic audit done at Lac Courte Oreilles was ordered by Chairman Gordon Thayer in June of 2013. Thayer is no longer on the governing board. He hired Forensic Solutions, LLC.

At the time, the auditors found possible widespread fraud throughout the tribe, but asked for more money to prove it. The audit they were hired to perform, which was an examination of finances, only found the possible fraud. The audit would have cost a lot more money because of the time involved for an in-depth investigation, putting a strain on the tribal budget.

Congressman Duffy said previous audits have found some cause for concern but they were not so thorough as to offer recommendations for change and as a result, some of the same issues have continued to be raised.

“Just as the tribe has an obligation to spend federal money consistent with the purpose of appropriations, the federal government has every right to verify that those taxpayer dollars are being used for the intended purpose,” Duffy said. “Audits are a common, if not mandatory, procedure across all parts of Federal government regardless of who is receiving the money, including a tribe.”

He added, “Presuming the money is being spent accordingly, the tribal leaders should welcome the opportunity to show that they are doing right by their members.”

Some things addressed in the 2013 audit included transferring of federal grant monies between different bank accounts without tribal council signature approvals; sixty-two bank accounts opened when not nearly that many were needed; excessive NSF bank charges; grant dollars mishandled jeopardizing future grants; use of employee health insurance premiums to pay for non-related expenses; thousands of vendor addresses matching employee and other vendor addresses; gift cards purchased and charged to federal grant funds; several outstanding loans that had no originating documentation; and hundreds of thousands of dollars in gas vouchers given away.

An LCO tribal elder, Marilyn Tribble, points out that there hasn’t been a real federal audit of our tribe, or a forensic audit since the 2013 audit.

“I don’t trust any of these audits done by our own tribe,” Tribble said. “What we need is a federal audit.”

Tribble and a group of concerned LCO tribal members were responsible for the petition turned in to Congressman Duffy. She said forensic audits cost a lot of money and she hopes that if the federal government sees the need for it at LCO, maybe they will waive the cost.

“Our tribal program funds are being mismanaged,” Tribble said. “People are not receiving the services they should. It’s been years and years of mismanagement by Secretary-Treasurer Norma Ross and Chairman Mic Isham. They are shifting money around between this bank account and that bank account and our school goes without, so our kids are suffering and our clinic isn’t paying the bills of our patients and housing is charging hundreds of dollars a month for people to live in moldy houses.”

Tribble said LCO Housing received a large mold remediation grant last year to fix moldy houses but it hasn’t been started.

Glenda Hall of the LCO Housing Authority said that Phase 1 of the grant has been implemented and Phase 2 is set to start in November. Each phase is the remediation of five homes. The grant was in the amount of $650,000 to fix over 70 tribal homes.

“We’re hoping that a federal forensic audit will discover any mismanaged or illegal activity from any current or past tribal council members,” Tribble said. “If it happened, this audit will find out a lot for our people.”

Tribble said there are so many issues concerning tribal leadership that she wishes she could sit down with Congressman Duffy and talk more about it. She cited one example, the large turnover of tribal member employment, replacing them with non-tribal members. She said those non-tribal members are becoming directors of these mismanaged programs and then turning around and giving themselves large bonuses. One director gave herself a $9,000 bonus.

Tribble said LCO Chairman Mic Isham has struck fear into many tribal members so they are afraid to speak out.

“He threatens them with their jobs and because they fear losing their jobs, many people wouldn’t put their names to the petition,” Tribble said.

Isham said the petition doesn’t mean much because there are only 113 tribal members who signed it and that only represents a small percentage of tribal membership. Tribble pointed out that only a little over 800 tribal members actually vote in tribal elections, so it represents 1/8 of that membership despite the threat of losing their jobs.

“But Isham doesn’t speak for all tribal members,” Tribble said. “We didn’t vote him as our chairman, he was appointed by the other council members.”

The 2013 audit findings

There was a total of 17 findings reported by Forensic Solutions, LLC, in 2013, with several of them directly related to mismanagement of federal funds.

“A review of the LCO Tribe’s management response to the CPA financial audits for the years 2009-12 indicated a consistent failure to appropriately respond to their findings as outlined in our report titled Management’s response to audit findings 2009-12,” the report said.

In a letter dated August 13, 2013 (exhibit 2) to LCO leadership, the auditor, Thomas Buckhoff, said that after reviewing the Independent Auditor’s Report and Special Revenue Fund Financial Statements for the LCO tribe for the years ending 2009-12, management consistently failed to respond to their findings and recommendations. He went on to cite examples of this such as management's failure to provide Management’s Discussion and Analysis supplements to each of the four years as this is required by the Governmental Accounting Standards Board because it helps to place the financial statements in an appropriate operational, economic and historical text. The auditors pointed this failure out and yet management refused to provide this supplement to its financial statements.

Buckhoff wrote in the letter that there were several conditions reported in 2009 that were unresolved as well, including the tribe’s failure to record matching requirements of funds provided; indirect cost proposals weren’t submitted in time to receive new rates; five different instances in 2008 where legally-required reports were not submitted; property records are incomplete and not being updated when new purchases are made; four different instances in 2008 where required report reconciliations weren’t done; and in 2008, the tribe did not have sufficient cash in the special revenue funds to cover deferred revenue from major program grants and contracts. The insufficient grant funds continued on throughout the four-year period.

“The concerns of the Midwest Professionals CPA firm were expressed in two letters dated June 30, 2011 and July 16, 2012. No action was ever taken on the issues in those letters,” Buckhoff wrote.

In the first letter of June, 2011, Midwest Professionals told the LCO Tribal Governing Board that after interviewing various employees they were concerned about widespread fraud, but they didn’t investigate them and couldn’t provide any assurance as to whether the instances of fraud did actually occur. They said these were areas of potential risk, which included missing clinic money at the tribal office, petty cash money missing, employees illegally spending tribal money without having to pay it back, forged signatures to draw down federal grant money, and more.

Several specific allegations were listed;

Concern surrounding the use of federal grant funds for the construction of the Early Headstart, specifically, it was claimed that playground money was not used towards the construction of the playground;

Blank transfer forms are pre-signed without actual authorization from the signers (i.e. digital signatures). Deposits delivered to the tribal office from the clinic have gone missing (with emphasis being on the tribal office as the perpetrator);

There was an indication of forgery of approval signature on federal grant draw-downs;

Individuals that were caught spending money for personal purposes and charging it to the program, Indian Health Services, were not required to pay the money back;

There were indications that money is being stolen from petty cash funds, and that persons with access to the accounting software are reducing amounts that they owe;

The tribe is not recognizing fair labor laws for overtime;

The health director assigned authorized signers that are under his control and then uses these signers to pay for personal expenditures.

Then in July of 2012, Midwest Professionals delivered another letter to our tribal council indicating a few more areas of concern, which included;

Multiple staff attending the same conferences/training each claim mileage for reimbursement while actually car-pooling to the event;

Deposits from the Medical Records department are taken to the accounting department and have “disappeared.” Some medical records cash is not turned in on a regular basis and has been taken without proper authority by employees for personal use;

Medical Records cash “borrowed” and on a couple of occasions not recovered from Tribal administration accounting office.

The audit report stated, “The large number of bank account transfers and commingling of tribal funds, the lack of funds, and the excessive NSF bank charges placed the LCO tribe in a precarious financial position. It was also found that vendor checks occasionally were prepared but not mailed or otherwise delivered to the vendor for over a year. Some grant funds that required stricter accounting were not drawn upon but those grants that did not require the stricter accounting were drawn down and sometimes those grants were overdrawn. The collective actions placed the LCO tribe not only in a precarious financial position but placed them in danger of losing future grants if those actions had continued.”

Under statutes from Title 42 of the Code of Federal Regulations, once the tribe commingled tribal funds, state funds and federal funds, all the funds are treated as federal funds and any mishandling of these funds becomes the mishandling of federal funds.

The audit discovered that LCO Tribal Comptroller Norma Ross, who is now the Secretary-Treasurer of the tribal governing board, had over three dozen bank accounts set up on behalf of the governing board in locations throughout Minnesota and Wisconsin. The audit found that money was being transferred between them, without proper authorization, creating a mess where some grants were overdrawn while others weren’t completely drawn down.

Forensic Solutions LLC recommended that Norma Ross not have any further control of any tribal funds ever again. She was elected to the tribal council not long after the report was released. The members of the tribal governing board in 2013 then chose her to be treasurer of the tribe’s finances where she still holds the position today.

The audit report said, “A review was conducted of the bank authorization transfer forms for a randomly selected 20-month period covering the fiscal years 2010, 2011, and 2012. The LCO Tribal policy is two original signatures are required on the form prior to initiating the bank transfers. During the 20 months, a total of 312 transfer forms were reviewed with the finding of 214 transfer forms having two original signatures while the remaining 98 financial transfer forms had at least one photocopied signature. The number of photocopied signature forms represented a 31.4% of the total forms.”

What this finding showed is Norma Ross had transferred federal funds between bank accounts 98 times during that 20-month period without the required two tribal council member signatures. One of every three bank transfers weren’t approved by the tribal governing board in the proper way.

“A review of the general ledger found a significant number of account transfers for the fiscal years 2011 (1032 transfers); 2010 (2228); and 2009 (1323). The sheer number of transfers and commingling of funds and accounts makes it nearly impossible to follow the trail of money and the eventual disposition of those funds,” the auditors said.

The auditors asked Norma Ross about the excessive number of transfers. She stated the BIA wouldn’t transfer the money into the proper accounts and that caused problems necessitating the transfer of funds. She further advised the worse program was the IHS water and sewer system program, as funds were coming in from USDA, EPA, IHS and went into four different types of accounts for construction, etc.

She concluded by stating, “I was just trying to keep up with the bank.”

Audit finding #6 included the excessive bank overdraft fees with Chippewa Valley Bank.

“A review of the general ledger found a total of $491,385.46 in Non-Sufficient Fund (NSF) charges for the fiscal years 2010, 2011 and 2012. The amount breakdowns per fiscal year are: 2010-$58,187.75; 2011-$115,741.09; and 2012-$317,456.62. Included in these amounts are normal bank charges but those bank charges are minimal.”

Audit finding #8 said, “Health Insurance Premiums have been deducted from tribal employee paychecks for a number of years to supplement the cost of health insurance premiums. A review of this account indicates numerous financial transfers from the employee health insurance account to other tribal accounts to pay expenses not related to health insurance.”

Audit finding #9 said, “A review of employee addresses to vendor addresses was conducted. This comparison was performed to ensure there were no conflicts of interest between the employees and the vendors. The data mining found the following: 18,743 of 28,528 (or 65.7%) vendors had no Taxpayer ID listed (EIN or SSN); 1,909 of 28,528 (or 6.7%) vendors had no address listed; 23,604 of 28,528 (or 82.7%) vendors had no phone number listed; 1,791 of 28,528 (or 6.3%) vendors had all three of the above irregularities; It is common and prudent business practice to require a Taxpayer ID number, an address, and a phone number before paying vendor invoices. The absence of basic vendor contact information creates a fertile breeding ground for vendor fraud schemes. There is an urgent need to update the vendor files in order to ensure no suspicious activity between employees and vendors. The files will not be exhibited due to the sensitive nature of the information.”

Thomas Buckhoff provided a letter to the tribal council dated July 22, 2013, in regards to the data mining of vendor and employee listings. In that letter, Buckhoff said he attempted to determine if any vendors shared addresses either with other tribal vendors or with tribal employees.

“I sorted both the Vendor Listing and Employee Listing by the address data field and began an “eyeball” comparison between the two listings. Given the extremely large number of vendors (28,528), this task became tedious and would have taken hours to complete. Based on this task, I estimate there are thousands of vendors who share addresses with other tribal vendors and/or with tribal employees. This irregularity indicates a high risk of fraud.”

Congressman Duffy has requested a response from the four federal agencies by October 20th, 2016.

Last Update: Apr 11, 2017 8:16 am CDT